Newsletter May 28, 2022: Victoria and Oak Bay do not have an “Unaffordable Housing Crisis”

Please note the article in Appendix #1 is Oak Bay Watch’s Featured Weekly Article May 22-29.

Victoria and Oak Bay do not have an “Unaffordable Housing Crisis”. What they do have is an “Unaffordable Land Crisis” that unfortunately, Oak Bay can do very little to solve (Appendix #1).

However, Council intends to implement solutions that will not make land any less expensive and could potentially have the opposite effect.

The action Council is planning to take is to densify our single-family neighbourhoods with secondary developments. Council will also be discussing increasing the number of boarders.

Notwithstanding, that Council has not explained how it will combat the resulting impacts and problems these zoning changes will cause, this intended zoning change will undoubtedly add a significant new population whose rents cannot be taxed by the municipality.

However, taxed new development, according to the District, must cover these costs:

- The increase in policing, fire fighting, recreational and other amenity costs.

- New infrastructure that needs to be replaced and maintained.

- Additional enforcement and registration costs;

- Additional traffic control devices.

Untaxed secondary development, however, does not provide this revenue so existing taxpayers will be footing the bill for the required new municipal services.

The evidence also shows that a change to the Zoning bylaw to allow, multi-tenant, open-ended secondary accommodation has only increased the number of unregulated secondary accommodation. It also drives up housing and rental costs. Oak Bay’s rental costs are, at present, higher or as high as any other CRD municipality. So much for affordability.

If Council is looking for an effective housing affordability action, they could easily stop the demolition of the more affordable smaller homes (the majority in Oak Bay) that are replaced with houses that are often twice the size and three times the cost.

Council meeting August 15, 2011: “The Director of Building and Planning brought to Council’s attention that he had received many complaints about the size of dwellings permitted on these small lots”. See full text (Appendix #2 and Council’s unacted-upon directive).

"Don't ever take a fence down unless you know why it was put up" Robert Frost

Oak Bay Watch Perspective

The Globe and Mail reported that Patrick Condon, a professor of urban design at the University of British Columbia, had this to say about Canada’s Housing Price Crisis “More recently, I’ve come to understand that the problem isn’t the building (price), it’s the (price of) land underneath the building. When we encourage new density, unfortunately it doesn’t help the renter or the home purchaser, who it really helps is the land speculator.

If an Urban Design Professor, who teaches the planning and mapping of cities, towns, and streets and creating new facilities and developments has just figured out that urban land speculation and investment is the main housing price factor, it’s no wonder this has been so well concealed from the public.

Prof. Condon says that he too was a long-time proponent of supply as a solution, but research has proved otherwise. He added this example: “Of any place in the world and certainly North America, Vancouver probably, has added more supply as a percentage of its population, and yet its prices have gone up 300 per cent over three decades.”

To understand why our housing is unaffordable for so many of our Canadian Residents due to the cost of land, one only has read what Canada’s Housing Minister, Ahmed Hussen had this to say in December 2021: “Canada needs temporary ban on foreign buyers to ease affordability crisis.” And, “Housing should be for Canadians to live in, not passive foreign investment.

However, his solution is:

More Supply by abolishing single-family zoning, that is to eliminate the “Home with a White Picket Fence” era, that the development industry has been promoting all these years. He wants to make foreign investors even richer by removing what has been the cornerstone of communities. The housing minister has recommended sub-dividing single-family lots and building congested. much less adequate, habitable multi-dwellings. See Link:

”https://nationalpost.com/news/politics/ban-foreign-home-buyers-rezone-cities-for-more-density-to-reduce-housing-crunch-federal-minister

The multi-dwelling units the housing minister wants to permit on subdivided, single-family lots are: duplexes, triplexes, and most likely, allow land assembly for apartment blocks. Hussen said he supports the foreign buyer ban, but did not provide any details on how and when it would be implemented.

Unfortunately, BC’s Housing Minister has the same mindset. More and more supply in less space, is also his solution. He also wants to have the last say on every community’s built form. The announced Federal 2-year, “proposed” foreign investment ban has so many loopholes (see Appendix #1 - exemptions) it will have no impact on housing prices.

Unfortunately, neither of these Housing Ministers seems aware that Vancouver, Victoria and other Canadian cities have for some years now, implemented the same unsuccessful ramping-up housing supply initiatives that the senior governments are now suggesting.

However, they seemed not to have noticed that housing prices, mainly due to land prices, keep increasing. Also, that many cities are undergoing urban migration: it has been reported due to the pandemic, that people want more space not less.

A proven solution: Douglas Todd Vancouver Sun: Jan 21, 2022

“While Canadian housing prices are shooting into the stratosphere largely due to an unprecedented surge by investors, Ottawa has done little to ease the destructive trend. Singapore however announced a 17-per cent surcharge on citizens who buy a second property, 30 per cent tax on their third property. as well as other measures to discourage investors. Canada needs to take heed.”

Singapore also places no extra tax on citizens who buy their first home.

See Appendix #1: Weekly Feature Article with much more information

_____________________________________

“Nothing is inevitable if you are paying attention” Oak Bay Watch

Oak Bay Watch is a volunteer community association and its members have a variety of professional backgrounds in both the public and private sector.

*******Please help us continue to provide you with information about Community concerns and Council decisions and actions. Oak Bay Watch members also help community groups with their specific development concerns. Donate to Oak Bay Watch - even $5 or $10 dollars provides expenses for door- to- door handouts and helps us maintain our website. Oak Bay Watch is committed to ensuring the Community gets the full range of information on budget, governance and all key development issues – a well-informed opinion cannot be made without this.

(Please use Donate Button at bottom of oakbaywatch.com Home Page)

Keep informed and sign up for our newsletter – bottom of Newsletter Menu Item.

Appendix #1: Douglas Todd Vancouver Sun: Jan 21, 2022

In Singapore, they don’t fool around on housing.

Douglas Todd: In Singapore, politicians are combating price jumps with dramatic taxes aimed at curbing speculation by both local and global investors, the latter made up mostly of people from China, the U.S. and India.

The southeast Asian city-state announced in December it will slap a 17 % tax on Singapore citizens who buy a second property and 30 per cent tax on their third property.

While Canada treats permanent residents like citizens when it comes to housing taxes, that’s not the case in Singapore. It has imposed a five per cent tax on permanent residents purchasing a first dwelling and 30 per cent on those buying a third residential property. Foreign buyers who want to enter Singapore’s hot market are now taxed a solid 30 per cent on any purchase whatsoever.

While some Singapore realtors worry that the anti-investor taxes will discourage luxury buyers, political leaders forge ahead. They have said they can’t build new housing supply fast enough to temper price jumps of nine per cent in the past year.

Yet Singapore’s hikes are mild compared to Canada's, where average prices have risen about 20 cent in a year. Investors now make up the largest group of buyers in some of Canada’s major markets. They’re going wild to take advantage of Ottawa’s monetary stimulus and extremely low interest rates.

The number of investors in Canadian housing is staggering.

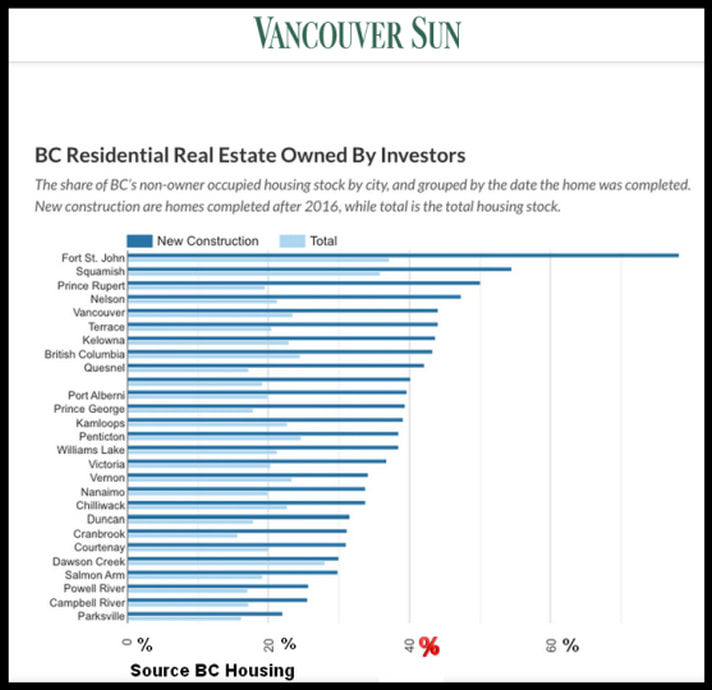

Of all the new homes built since 2016 in B.C., including Metro Vancouver, more than 40 per cent have been bought by investors, according to Statistics Canada. In Ontario, investors snag one in three recently constructed residential properties, contributing greatly to unaffordability.

Investors are squeezing many other buyers out.

The share of transactions last year by first-time homebuyers in Chilliwack, for instance, dropped to eight per cent from 15 per cent the year before, says SFU researcher Any Yan. That’s while the number of residential transactions in the city’s fiery market grew 50 per cent.

One of the few things the federal Liberals are considering to curb housing speculation is requiring higher down payments on investment properties. Singapore is way ahead on that, too. It recently ruled homeowners cannot spend more than 55 per cent of their gross income on mortgage payments.

David Eby, minister responsible for housing, is against creating new housing taxes. But advisers think he may be open to fine-tuning existing ones. Note: He favors “a Business as Usual” approach

Even before the pandemic arrived, Vancouver architect Michael Geller said, the Canadian Housing Statistics Program showed about 300,000 homeowners in B.C. owned two or more properties. At least 62,000 of them are invested in three or more dwellings, often condos. Given the problem, Geller said it’s worth considering extra property taxes on people who buy more than one dwelling.

B.C. and Ontario already have foreign-buyers taxes covering their major urban markets. And Prime Minister Justin Trudeau has talked about instituting something this year on non-resident-owned empty dwellings.

Oak Bay Watch Note: B.C. and Ontario’s foreign-buyer taxes are minimal and nowhere near what is required to decrease housing prices. David Eby, questioned about students buying up multi-million dollar mansions, had this to say:

“It’s incredibly strange that a student would be able to afford such a luxurious and multi-million-dollar property,”. “This is part of a trend of homemakers and students mass-buying property. I don’t know how that can be possible with the income of homemakers and students typically have, which is close to zero.”.

Source: Toronto sun.com/2016/05/12/311-million-vancouver-mansion-owned-by-student

Yet the federal government, apparently unaware of this information, intends to exempt “students” from their announced 2-year (only) ban on foreign owners purchasing property.

Even though he is a developer, Geller “reluctantly” admits such taxes “may play a role in moderating house prices.” Meanwhile, Vancouver’s luxury realtors, such as Layla Yang, make clear such taxes are a deterrent.

Other tax ideas have come forward. UBC-based Generation Squeeze, in an effort to reduce demand and help those frozen out of ownership, recently called for a national surtax on all dwellings valued at more than $1 million.

But B.C. Housing Minister David Eby, and other politicians, have rejected the idea.

Still, Rhys Kesselman, a former public policy professor at Simon Fraser University and recent adviser to the NDP government, said Singapore’s measures are “very strong.” He expects they will have a measurable affect on housing in the well-off island state of 5.5 million people.

In Singapore, which has a high proportion of leased housing, real-estate analysts have predicted the government’s boosted taxes on investors will reduce price rises to zero to three per cent in 2022.

The Chart shows 44 per cent of all houses and condos built since 2016 in Vancouver are bought by investors. (Source: Better Dwelling)

Since Eby said this month he doesn’t want to bring in new types of housing taxes, Former public policy professor Rhys Kesselman proposes B.C. tighten the 2018 speculation and vacancy tax.

It currently amounts to two per cent of property value for foreign owners and satellite families, or 0.5 per cent for Canadian citizens or permanent residents of Canada who are not in a satellite family.

Kesselman would target an apparent loophole in the tax’s vacancy rule. It allows homeowners who leave their main dwelling empty to avoid the tax by simply renting out a portion of the property, such as a suite or laneway house.

One of Kesselman’s ideas would be to get rid of the so-called tenancy exemption for foreign owners and satellite families, defined as those where the breadwinner makes more than half of their income offshore, where it is untaxed by Canada.

A variation on that idea would be to stop the tenancy exemption for all domestic and foreign owners, who are in possession of more than one dwelling in B.C.’s urban centres.

“There is no doubt that any of these measures would significantly increase revenues from the speculation and vacancy tax,” said Kesselman. They would also “induce more properties to be shifted from ownership to the rental market.”

The B.C. government estimates the speculation tax has brought in $231 million and led to an estimated 18,000 new units going on the rental market.

The speculation tax could also be fine-tuned to deal with one of its unintended consequences, says Kesselman. The revision would ensure people like Richmond homeowner Tony Chan, who isn’t an investor but has a spouse who lives outside the country, don’t have to pay it.

“I would suggest,” said Kesselman, “that an appropriate change would be to exempt a family otherwise deemed to be a satellite family if the resident spouse had made contributions to the Canada Pension Plan for at least 20 years previously.

“That would exempt persons who had been long time residents of Canada and had been working and making CPP contributions and almost certainly been income-taxable in Canada for that period.” Of course, Kesselman said, he has more ambitious policy ideas to deter housing investors. But, at this point, he says they probably wouldn’t fly with Eby.

“Or they run into other barriers, since immigration into B.C. is a major determinant of the housing crisis. And that is a federal jurisdiction,” he said. Whatever happens, any new taxes in Canada would likely not come close to matching those in Singapore, where politicians have proven much bolder at trying to resolve housing crises.

Sun Article Comment

The Government is irremediably addicted to using housing as an open market commodity. No matter how this affects so many Canadian residents. I guess selling Real Estate to foreigners is the basis for our economy.

Appendix #2:

August 15, 2011 Council Meeting:

Council then passed a motion to have staff assisted by Councillor Jensen review the 2007 Floor Area (FAR) Committee’s work with respect to the floor area regulations as they relate to small lots and report back.

Note: Councillor Jensen and 2 other members, that were connected to the Development Industry, were on the 4-member Special Council Committee that recommended the zoning bylaw changes (in 2007). The previous Director of Building and Planning, the 4th member of the 2007 FAR Committee, and Oak Bay resident submissions warned the Council of the day, and accurately predicted, that if the zoning was changed overly large houses on small lots would be the outcome.

Council nevertheless approved the majority FAR Committee recommendation to change the highly regarded Oak Bay Zoning Bylaw, stating they would make modifications if required.

In addition to the many resident complaints referenced by the Director of Building and Planning on April 15, 2011, hundreds of residents have appeared before Council through the next three Council terms (2011- 2022), requesting that Council correct this invasive, over building problem.

Although this problem has been recognized by some of the present Council, no effective action has been taken to address it. This is even though it is an Oak Bay environmentally destructive, character-changing, and effect on other properties (loss of sunlight, privacy and views) and a resident concern.

Since Eby said this month he doesn’t want to bring in new types of housing taxes, Former public policy professor Rhys Kesselman proposes B.C. tighten the 2018 speculation and vacancy tax.

It currently amounts to two per cent of property value for foreign owners and satellite families, or 0.5 per cent for Canadian citizens or permanent residents of Canada who are not in a satellite family.

Kesselman would target an apparent loophole in the tax’s vacancy rule. It allows homeowners who leave their main dwelling empty to avoid the tax by simply renting out a portion of the property, such as a suite or laneway house.

One of Kesselman’s ideas would be to get rid of the so-called tenancy exemption for foreign owners and satellite families, defined as those where the breadwinner makes more than half of their income offshore, where it is untaxed by Canada.

A variation on that idea would be to stop the tenancy exemption for all domestic and foreign owners, who are in possession of more than one dwelling in B.C.’s urban centres.

“There is no doubt that any of these measures would significantly increase revenues from the speculation and vacancy tax,” said Kesselman. They would also “induce more properties to be shifted from ownership to the rental market.”

The B.C. government estimates the speculation tax has brought in $231 million and led to an estimated 18,000 new units going on the rental market.

The speculation tax could also be fine-tuned to deal with one of its unintended consequences, says Kesselman. The revision would ensure people like Richmond homeowner Tony Chan, who isn’t an investor but has a spouse who lives outside the country, don’t have to pay it.

“I would suggest,” said Kesselman, “that an appropriate change would be to exempt a family otherwise deemed to be a satellite family if the resident spouse had made contributions to the Canada Pension Plan for at least 20 years previously.

“That would exempt persons who had been long time residents of Canada and had been working and making CPP contributions and almost certainly been income-taxable in Canada for that period.” Of course, Kesselman said, he has more ambitious policy ideas to deter housing investors. But, at this point, he says they probably wouldn’t fly with Eby.

“Or they run into other barriers, since immigration into B.C. is a major determinant of the housing crisis. And that is a federal jurisdiction,” he said. Whatever happens, any new taxes in Canada would likely not come close to matching those in Singapore, where politicians have proven much bolder at trying to resolve housing crises.

Sun Article Comment

The Government is irremediably addicted to using housing as an open market commodity. No matter how this affects so many Canadian residents. I guess selling Real Estate to foreigners is the basis for our economy.

Appendix #2:

August 15, 2011 Council Meeting:

- ”The Director of Building and Planning brought to council’s attention that he had received many complaints about the size of dwellings permitted on these small lots”.

- “The amount of floor area is quite high given the maximum is a fixed amount.”

- “He suggested that Council investigate if amendments to the zoning bylaw would be desirable to address what appears to be an inconsistency in the regulations.”

Council then passed a motion to have staff assisted by Councillor Jensen review the 2007 Floor Area (FAR) Committee’s work with respect to the floor area regulations as they relate to small lots and report back.

Note: Councillor Jensen and 2 other members, that were connected to the Development Industry, were on the 4-member Special Council Committee that recommended the zoning bylaw changes (in 2007). The previous Director of Building and Planning, the 4th member of the 2007 FAR Committee, and Oak Bay resident submissions warned the Council of the day, and accurately predicted, that if the zoning was changed overly large houses on small lots would be the outcome.

Council nevertheless approved the majority FAR Committee recommendation to change the highly regarded Oak Bay Zoning Bylaw, stating they would make modifications if required.

In addition to the many resident complaints referenced by the Director of Building and Planning on April 15, 2011, hundreds of residents have appeared before Council through the next three Council terms (2011- 2022), requesting that Council correct this invasive, over building problem.

Although this problem has been recognized by some of the present Council, no effective action has been taken to address it. This is even though it is an Oak Bay environmentally destructive, character-changing, and effect on other properties (loss of sunlight, privacy and views) and a resident concern.