Newsletter July 1, 2023 A Bizarre New Category on the 2023 Tax Bill Pie-Chart

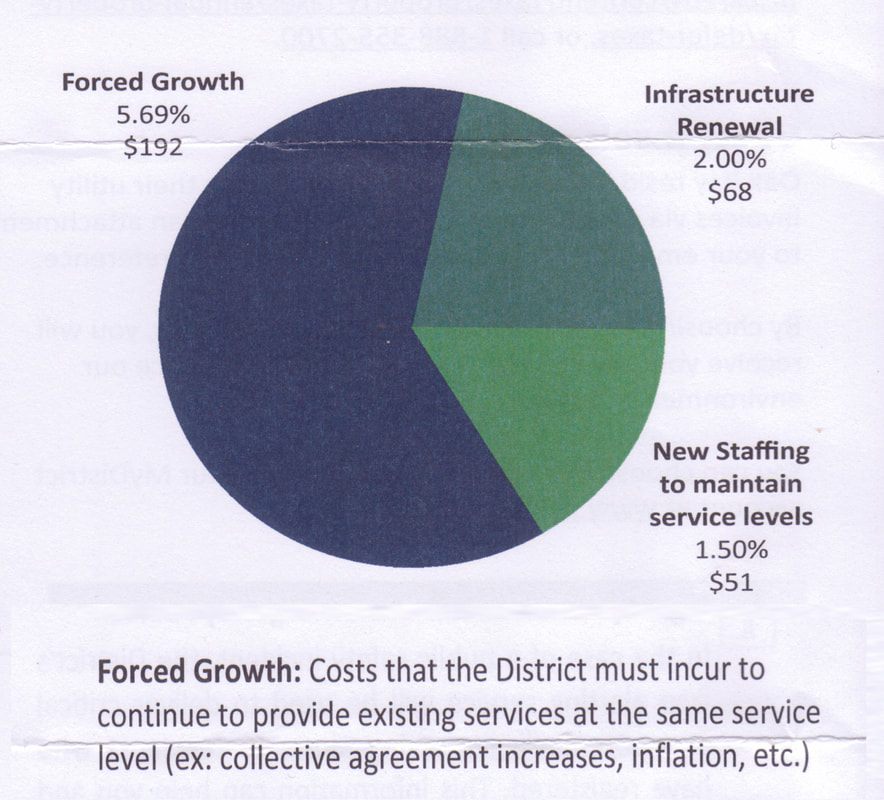

The 2023 District of Oak Bay tax bill includes a pie-chart that is divided into just three categories (See Tax Bill Pie-Chart Appendix #1). However, the chart provides very limited information about your property tax expenditures. The little information it does tell you is that the New Staffing “slice” rivals the allocated expenditures for the District’s Infrastructure Renewal “slice” that includes the District’s roads, sewers, and water etc.

The third category, the Forced Growth “slice” the largest expenditure is to maintain service levels by covering the District’s "collective agreement”, inflation, etc.” costs.

It is notable that the Forced Growth and New Staffing categories both claim that their expenditures are to maintain service levels. The Forced Growth explanation identifies some of these service levels. The New Staffing “slice”, includes the costs for all the new and budgeted administration staff however, it does not say what service levels all this new administration staffing will maintain.

Since 2019, the Administration budget has increased over $2,000,000.

No matter how many more administrative staff are added, now an annual event, the more staff say they are overworked and that many more staff are needed.

Oak Bay Watch Perspective

Oak Bay Watch has stated many times how administration staffing and the property taxes have increased annually, year in and year out, by leaps and bounds. Recent Councils have spent hundreds of thousands of tax dollars on new administration staff, consultants and their densification initiatives. These initiatives have been very costly for existing taxpayers. It seems there is no understanding that Oak Bay is a very small District with a very limited tax base.

Oak Bay’s recently approved legislation that legalized multi-tenant basement suites. This will not generate any additional property taxes. There also has been no indication of how much of the new planned infill will be taxed either. This will result in existing Oak Bay residents paying high taxes for the new municipal services and all the other impacts.

Staff have indicated more staff may be required to process and register the new and untaxed rental units. However, as recently pointed out by Councillor Paterson, there has been very little uptake so far to register basement suites. And only 9 to 15 Infill units are expected to be registered annually. These statistics raise many questions, for example:

Staffing: The more administrating staffing the less flexibility there seems to be. Every Council priority and request is now locked in to work plans and strategic priority reports. Every Council decision or issue requires a report or “backgrounder”. Many of them recommending a consultant or removing or delaying a work plan or priority item.

This is no surprise, efficiency experts explain that the bigger the administration is the more inefficient the organization becomes (more about this in a future newsletter}. No matter how many administration staff the District hires, the consistent message to Council is how busy and flat-out the administration staff are.

It seems to us however, that this does not apply to senior staff who in the past did much of the departments administration work. Now they “supervise”, have lots of time to call for and contract consultants, write more and much longer reports, attend most Council meetings, attend leadership team meetings and often appear at Council’s volunteer commissions and committees.

It should be obvious to Council that the tax bill pie-chart has sent a message explaining just how out of control this administration staff expansion has become. This is also confirmed by the administration’s inflationary annual budget increases. As well, the fact that all the new office space that was crated renovating the municipal hall was not enough to accommodate all the new administration staff.

Additionally, $36,550 tax dollars annually have been approved, to lease commercial office space in an adjacent building for 8 to 12 new staff. No estimate has been provided for the hardware costs (office furniture, computers, printers, phones etc.).

What is not clear is why Oak Bay Councils are only listening to staff after staff request for more staff, while they continue to ignore the economic conditions their residents are faced with and no end in sight. It’s not just the year after year very high tax increases, it’s also the escalating costs of just about everything else. Senior staff are always going to request more staff and if this is consistently approved it has been defined as allowing “empire building” – that is not a healthy practise for any organization.

Council will be held accountable for their ”go along to get along with the staff ” mindset and their failure to bring spending under control and, understand the economic realities of their decisions and actions.

------------------------------------------------------------------------------------------

“Nothing is inevitable if you are paying attention” Oak Bay Watch

Oak Bay Watch is a volunteer community association and its members have a variety of professional backgrounds in both the public and private sector.

*******Please help us continue to provide you with information about Community concerns and Council decisions and actions. Oak Bay Watch members also help community groups with their specific development concerns. Donate to Oak Bay Watch - even $5 or $10 dollars provides expenses for door-to-door handouts and helps us maintain our website. Oak Bay Watch is committed to ensuring the Community gets the full range of information on budget, governance, and all key development issues – a well-informed opinion cannot be made without this.

(Please use Donate Button at the bottom of oakbaywatch.com Home Page)

Keep informed and sign up for our newsletter – at the bottom of the Newsletter top Menu Item.

Appendix #1

Oak Bay Tax Bill Pie-Chart

The 2023 District of Oak Bay tax bill includes a pie-chart that is divided into just three categories (See Tax Bill Pie-Chart Appendix #1). However, the chart provides very limited information about your property tax expenditures. The little information it does tell you is that the New Staffing “slice” rivals the allocated expenditures for the District’s Infrastructure Renewal “slice” that includes the District’s roads, sewers, and water etc.

The third category, the Forced Growth “slice” the largest expenditure is to maintain service levels by covering the District’s "collective agreement”, inflation, etc.” costs.

It is notable that the Forced Growth and New Staffing categories both claim that their expenditures are to maintain service levels. The Forced Growth explanation identifies some of these service levels. The New Staffing “slice”, includes the costs for all the new and budgeted administration staff however, it does not say what service levels all this new administration staffing will maintain.

Since 2019, the Administration budget has increased over $2,000,000.

No matter how many more administrative staff are added, now an annual event, the more staff say they are overworked and that many more staff are needed.

Oak Bay Watch Perspective

Oak Bay Watch has stated many times how administration staffing and the property taxes have increased annually, year in and year out, by leaps and bounds. Recent Councils have spent hundreds of thousands of tax dollars on new administration staff, consultants and their densification initiatives. These initiatives have been very costly for existing taxpayers. It seems there is no understanding that Oak Bay is a very small District with a very limited tax base.

Oak Bay’s recently approved legislation that legalized multi-tenant basement suites. This will not generate any additional property taxes. There also has been no indication of how much of the new planned infill will be taxed either. This will result in existing Oak Bay residents paying high taxes for the new municipal services and all the other impacts.

Staff have indicated more staff may be required to process and register the new and untaxed rental units. However, as recently pointed out by Councillor Paterson, there has been very little uptake so far to register basement suites. And only 9 to 15 Infill units are expected to be registered annually. These statistics raise many questions, for example:

- Why would more new administration staff be required for such small numbers?

- Why aren’t basement suites taxed and why has there been no mention of taxing new infill rental units either? As indicated, existing Oak Bay residents are already covering most of the impact costs for existing suites and are expected to pay for the increased new suite service costs.

- What action can be taken if there is a big increase in illegal suites and infill? All other municipalities, after legalizing secondary rental units, have seen significant increases in illegal rental units. Reports have indicated that most suites in BC are unregistered.

- If a Surrey BC homeowner can register a secondary suite online, by using the city’s development tracking system, why can’t Oak Bay use this same process with the District’s new online development tracking system? Surrey also taxes secondary suites, explained to offset the increased service demands. Secondary suites are taxed at a rate of $1,908.69 annually (See https://www.surrey.ca/city-government/bylaws/secondary-suites). Why hasn’t Oak Bay staff provided these options?

Staffing: The more administrating staffing the less flexibility there seems to be. Every Council priority and request is now locked in to work plans and strategic priority reports. Every Council decision or issue requires a report or “backgrounder”. Many of them recommending a consultant or removing or delaying a work plan or priority item.

This is no surprise, efficiency experts explain that the bigger the administration is the more inefficient the organization becomes (more about this in a future newsletter}. No matter how many administration staff the District hires, the consistent message to Council is how busy and flat-out the administration staff are.

It seems to us however, that this does not apply to senior staff who in the past did much of the departments administration work. Now they “supervise”, have lots of time to call for and contract consultants, write more and much longer reports, attend most Council meetings, attend leadership team meetings and often appear at Council’s volunteer commissions and committees.

It should be obvious to Council that the tax bill pie-chart has sent a message explaining just how out of control this administration staff expansion has become. This is also confirmed by the administration’s inflationary annual budget increases. As well, the fact that all the new office space that was crated renovating the municipal hall was not enough to accommodate all the new administration staff.

Additionally, $36,550 tax dollars annually have been approved, to lease commercial office space in an adjacent building for 8 to 12 new staff. No estimate has been provided for the hardware costs (office furniture, computers, printers, phones etc.).

What is not clear is why Oak Bay Councils are only listening to staff after staff request for more staff, while they continue to ignore the economic conditions their residents are faced with and no end in sight. It’s not just the year after year very high tax increases, it’s also the escalating costs of just about everything else. Senior staff are always going to request more staff and if this is consistently approved it has been defined as allowing “empire building” – that is not a healthy practise for any organization.

Council will be held accountable for their ”go along to get along with the staff ” mindset and their failure to bring spending under control and, understand the economic realities of their decisions and actions.

------------------------------------------------------------------------------------------

“Nothing is inevitable if you are paying attention” Oak Bay Watch

Oak Bay Watch is a volunteer community association and its members have a variety of professional backgrounds in both the public and private sector.

*******Please help us continue to provide you with information about Community concerns and Council decisions and actions. Oak Bay Watch members also help community groups with their specific development concerns. Donate to Oak Bay Watch - even $5 or $10 dollars provides expenses for door-to-door handouts and helps us maintain our website. Oak Bay Watch is committed to ensuring the Community gets the full range of information on budget, governance, and all key development issues – a well-informed opinion cannot be made without this.

(Please use Donate Button at the bottom of oakbaywatch.com Home Page)

Keep informed and sign up for our newsletter – at the bottom of the Newsletter top Menu Item.

Appendix #1

Oak Bay Tax Bill Pie-Chart