NewslettersImportant Information for Oak Bay Property Tax Payers

Oak Bay Council’s Annual Budget decisions are usually made at Estimates Committee Meetings in April. However, this year for an unexplained reason and in the midst of the Covid 19 Pandemic, the meetings were held in February and March and identified as Financial Planning Meetings.

Almost six weeks after the March 12, 2020 budget deliberations were concluded and a budget increase of 8.1 % approved by Council, District senior staff recommended keeping all staff on salary as well as hiring more administrative staff. Senior staff also recommended a slight budget reduction of 1.2% as the District’s 2020 Financial Hardship Mitigation contribution. This, if approved by Council, would reduce the 8.1 % increase to 6.9%.

The slight 1.2% budget reduction presumably is because as staff has indicated, “Council is concerned that many residents will not be able to pay this year’s property taxes and this would result in an operational funding shortfall”. And “should revenue decline into subsequent financial periods, the budget gap would need to be addressed through increased taxation or decreased services”.

A Victoria based Taxpayer Association provides the following information in their April 15, 2020 newsletter:

“Most urban centres in Canada have responded to the crisis with budget cuts, layoffs and furloughs including Vancouver (1,500), Surrey (1,900 part-time), Delta (500), Ottawa (4,000 part-time), Calgary (1,200), Quebec City (2,000), Windsor (500), and Edmonton (2,000 non-essential). For a longer list go to Municipal World".

Many businesses, including Westjet and energy companies have laid-off staff. BC Transit has announced service reductions, extensive layoffs (30% to 70% of their workforce) as well as executive pay cuts. All these cuts are to begin this week. BC Ferries, cautious not to lose certified mariners, has furloughed (temporarily laid off ) 500 employees. Business enterprises understand staffing is the #1 business operational expense. They also understand how time-consuming costly, and unproductive it is to make work for stay-at-home staff.

Overview: It is difficult to understand why Oak Bay Council would require the services of so many of the District’s high priced $100,000 + specialized staff. By laying off all not needed staff due to the many service cutbacks, the District would avoid considerable expense. This would go a long way to counteract the funding shortfalls Staff and Council are so concerned about. Temporarily laid-off staff would receive a portion of their salary from the Federal Government thereby placing District staff on a similar footing with the many Oak Bay property taxpayers who have lost their jobs.

Oak Bay Watch Perspective

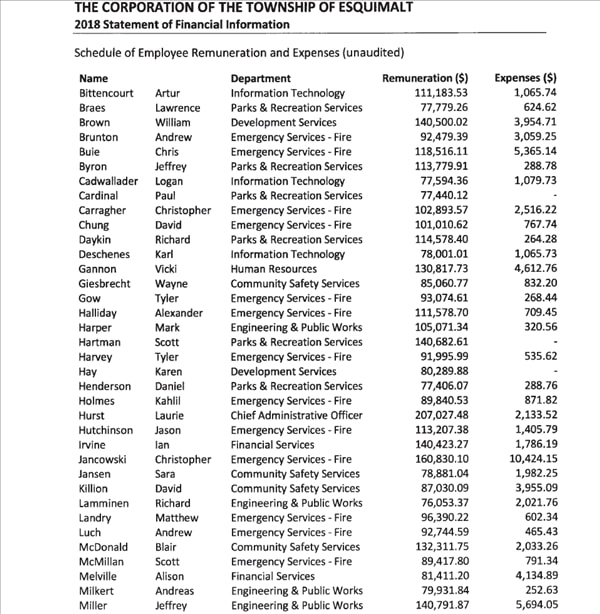

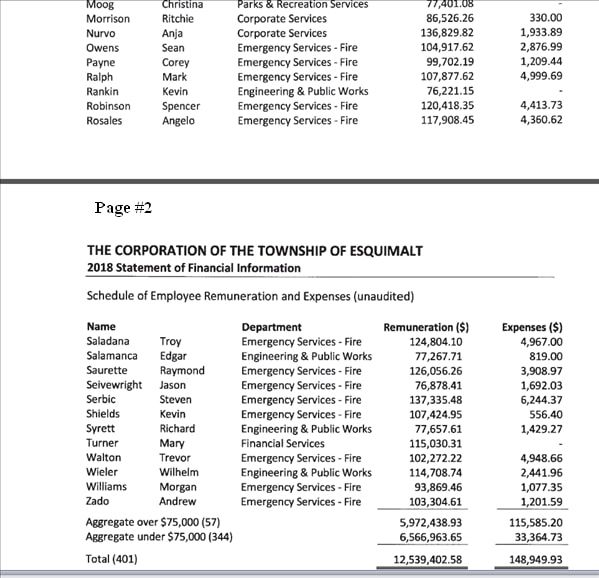

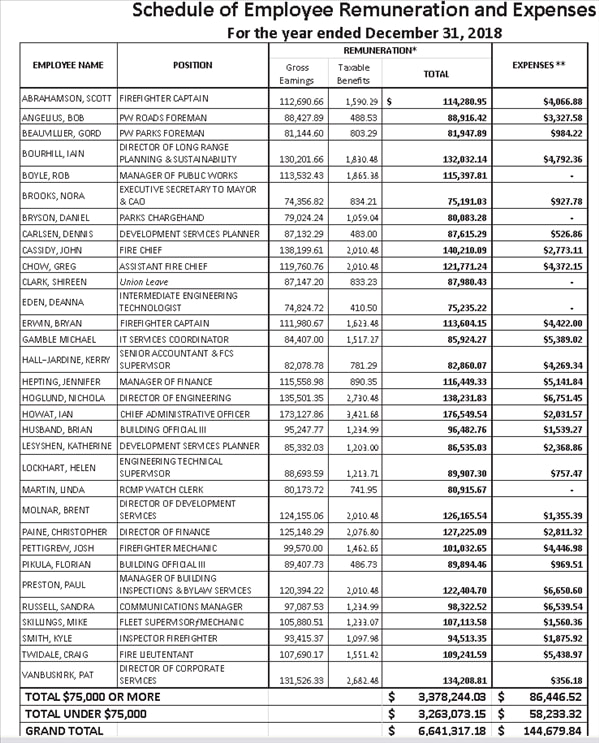

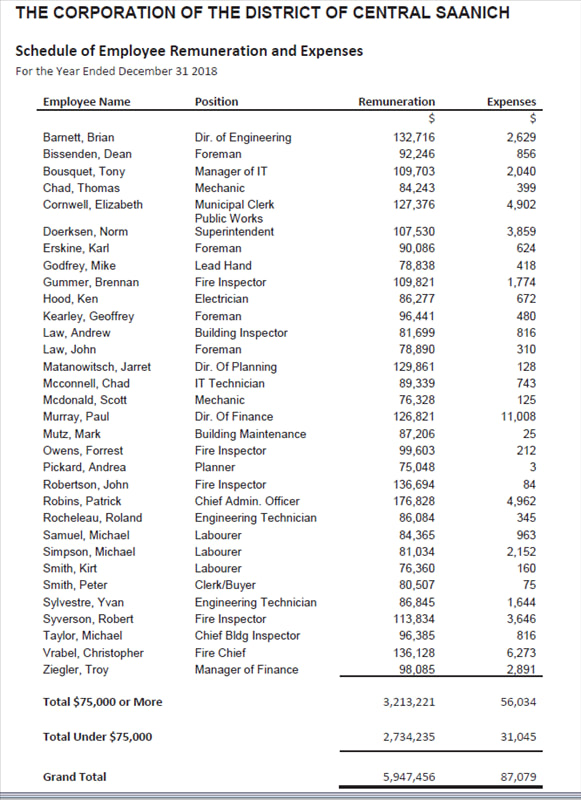

The last Annual Report (2018) reported the District’s staffing costs as $19.7 million. This is far beyond CRD’s comparably-sized municipalities like Esquimalt $12.5 million , Colwood $6.6 million and Central Saanich $5,9 million (see Appendix #1 for more detailed information)

Senior staff have had 6 weeks to prepare reports that attempt to justify retaining all staff at current salaries. The Community has had a week to process and respond to long complex staff reports that provide many questionable reasons for retaining all staff at their current salary levels. This is an example of poor communications, especially now the District has recently hired a highly-paid Communications Specialist.

While retaining all staff at current salaries can be considered a preferred reaction when staff is asked for their budget reduction preference. This is not acceptable as it does not take into account:

The past two Councils were criticized for inadequately funding our Infrastructure while substantially increasing the budget by unprecedented tax increases. This Council has stated their 2019 /2020 7 % tax increases are budget “catch ups” to correct this under-funding.

However, it seems to us that an analysis is required, explaining in detail, exactly what these substantial past increases were used for. For example, it is known that from 2015 to 2019 over a million dollars was budgeted annually for added administration staff and hundreds of thousands of tax dollars were used for expensive consultant contracts. How have Esquimalt, Colwood and Central Saanich managed to keep their staffing costs much much lower?

Council have failed to realize that the unprecedented tax increases are not one-time costs - they raise the tax base and compound year-after-year- after-year. Substantial budget cuts and efficiencies are the only way to maintain sustainable annual budgets. The interests of the Community must come before the interests of staff.

Although the continuing exceptional property tax increases are a major concern on an annual basis, a Staff report has concentrated taxpayer attention on this year's much smaller, slightly reduced and monthly $20 property tax payments. What is lost however, is the real financial danger of our rapidly expanded administration costs and annual budgets.

In 2012 the District budget was $19.2 million this has increased to an estimated $26.5 million in 2020 – This is over $7 million in property tax increases – an average of almost a million dollars a year (see Appendix #1 for more detailed information).

It is important Council recognizes the primary action taken by local governments and private companies all over Canada. That is, laying off not-needed staff is the most by far pragmatic and best financial option available. And in Oak Bay the fairest and most ethical option for Oak Bay taxpayers.

----------------------------------------------------------------------------

*******Please help us continue to provide you with information about Community concerns and Council decisions and actions. Oak Bay Watch members also help community groups with their specific development concerns. Donate to Oak Bay Watch - even $5 or $10 dollars provides expenses for door- to- door handouts and helps us maintain our website. Oak Bay Watch is committed to ensuring the Community gets the full range of information on budget, governance and all key development issues – a well-informed opinion cannot be made without this.

(Please use Donate Button at bottom of oakbaywatch.com Home Page)

Keep informed please sign up for our “based on facts” newsletter – bottom of Newsletter Menu Item.

APPENDIX #1

Oak Bay Council’s Annual Budget decisions are usually made at Estimates Committee Meetings in April. However, this year for an unexplained reason and in the midst of the Covid 19 Pandemic, the meetings were held in February and March and identified as Financial Planning Meetings.

- March 11, 2020 the World Health Organization declared COVID 19 as a pandemic;

- March 12, 2020 the District of Oak Bay concluded 2020 budget deliberations pending adoption of the annual Financial Plan Bylaw;

- March 17, 2020 District began lockdown of Municipal Hall and canceled many services and activated the Emergency Operations Centre;

- March 25, 2020 Federal Government passed an earlier announced Emergency Response Benefit Act that provides laid off workers with income for approximately 4 months;

Almost six weeks after the March 12, 2020 budget deliberations were concluded and a budget increase of 8.1 % approved by Council, District senior staff recommended keeping all staff on salary as well as hiring more administrative staff. Senior staff also recommended a slight budget reduction of 1.2% as the District’s 2020 Financial Hardship Mitigation contribution. This, if approved by Council, would reduce the 8.1 % increase to 6.9%.

The slight 1.2% budget reduction presumably is because as staff has indicated, “Council is concerned that many residents will not be able to pay this year’s property taxes and this would result in an operational funding shortfall”. And “should revenue decline into subsequent financial periods, the budget gap would need to be addressed through increased taxation or decreased services”.

A Victoria based Taxpayer Association provides the following information in their April 15, 2020 newsletter:

“Most urban centres in Canada have responded to the crisis with budget cuts, layoffs and furloughs including Vancouver (1,500), Surrey (1,900 part-time), Delta (500), Ottawa (4,000 part-time), Calgary (1,200), Quebec City (2,000), Windsor (500), and Edmonton (2,000 non-essential). For a longer list go to Municipal World".

Many businesses, including Westjet and energy companies have laid-off staff. BC Transit has announced service reductions, extensive layoffs (30% to 70% of their workforce) as well as executive pay cuts. All these cuts are to begin this week. BC Ferries, cautious not to lose certified mariners, has furloughed (temporarily laid off ) 500 employees. Business enterprises understand staffing is the #1 business operational expense. They also understand how time-consuming costly, and unproductive it is to make work for stay-at-home staff.

Overview: It is difficult to understand why Oak Bay Council would require the services of so many of the District’s high priced $100,000 + specialized staff. By laying off all not needed staff due to the many service cutbacks, the District would avoid considerable expense. This would go a long way to counteract the funding shortfalls Staff and Council are so concerned about. Temporarily laid-off staff would receive a portion of their salary from the Federal Government thereby placing District staff on a similar footing with the many Oak Bay property taxpayers who have lost their jobs.

Oak Bay Watch Perspective

The last Annual Report (2018) reported the District’s staffing costs as $19.7 million. This is far beyond CRD’s comparably-sized municipalities like Esquimalt $12.5 million , Colwood $6.6 million and Central Saanich $5,9 million (see Appendix #1 for more detailed information)

Senior staff have had 6 weeks to prepare reports that attempt to justify retaining all staff at current salaries. The Community has had a week to process and respond to long complex staff reports that provide many questionable reasons for retaining all staff at their current salary levels. This is an example of poor communications, especially now the District has recently hired a highly-paid Communications Specialist.

While retaining all staff at current salaries can be considered a preferred reaction when staff is asked for their budget reduction preference. This is not acceptable as it does not take into account:

- Councils concerns about many residents' inability to pay this year’s very high taxes and the resulting shortfall.

- Council’s commitment to: “Minimizing the long-term cost of operations for Oak Bay”.

- Retaining all staff (to work from home) despite the many service cuts; finding tasks for them to do and adding more expensive administrative staff - while so many other communities are taking advantage of the cost-saving Federal Government Subsidy Benefit.

The past two Councils were criticized for inadequately funding our Infrastructure while substantially increasing the budget by unprecedented tax increases. This Council has stated their 2019 /2020 7 % tax increases are budget “catch ups” to correct this under-funding.

However, it seems to us that an analysis is required, explaining in detail, exactly what these substantial past increases were used for. For example, it is known that from 2015 to 2019 over a million dollars was budgeted annually for added administration staff and hundreds of thousands of tax dollars were used for expensive consultant contracts. How have Esquimalt, Colwood and Central Saanich managed to keep their staffing costs much much lower?

Council have failed to realize that the unprecedented tax increases are not one-time costs - they raise the tax base and compound year-after-year- after-year. Substantial budget cuts and efficiencies are the only way to maintain sustainable annual budgets. The interests of the Community must come before the interests of staff.

Although the continuing exceptional property tax increases are a major concern on an annual basis, a Staff report has concentrated taxpayer attention on this year's much smaller, slightly reduced and monthly $20 property tax payments. What is lost however, is the real financial danger of our rapidly expanded administration costs and annual budgets.

In 2012 the District budget was $19.2 million this has increased to an estimated $26.5 million in 2020 – This is over $7 million in property tax increases – an average of almost a million dollars a year (see Appendix #1 for more detailed information).

It is important Council recognizes the primary action taken by local governments and private companies all over Canada. That is, laying off not-needed staff is the most by far pragmatic and best financial option available. And in Oak Bay the fairest and most ethical option for Oak Bay taxpayers.

----------------------------------------------------------------------------

*******Please help us continue to provide you with information about Community concerns and Council decisions and actions. Oak Bay Watch members also help community groups with their specific development concerns. Donate to Oak Bay Watch - even $5 or $10 dollars provides expenses for door- to- door handouts and helps us maintain our website. Oak Bay Watch is committed to ensuring the Community gets the full range of information on budget, governance and all key development issues – a well-informed opinion cannot be made without this.

(Please use Donate Button at bottom of oakbaywatch.com Home Page)

Keep informed please sign up for our “based on facts” newsletter – bottom of Newsletter Menu Item.

APPENDIX #1